by Ypatios Moysiadis

Article initially posted on cleantechgeek.com

The solar industry has entered a new age of maturity. New opportunities and challenges are knocking on our door. Conventional oil companies are racing to become the world’s biggest power firms. All the while utilities are looking to diversify their assets away from fossil fuels to cleaner and easily deployed renewable energy assets. Infrastructure funds are investing in solar and larger institutional investors want a slice of the market as it offers a predictable income for the long-term future.

With the massive reduction in solar project expenditure, we see new countries investing in solar and “old markets” remerging in Europe, such as Spain, Italy and France. Asset owners are now faced with the new challenge of managing assets across different geographies, with different regulatory and environmental challenges, not to mention different business models (subsidised, power purchase agreements (PPAs), pure merchant, etc.).

This creates a perplexing scenario for service companies and, in particular, solar asset managers.

In order to assist service companies and asset managers’ transition to this new solar reality, asset management needs to evolve.

Moving towards Solar Asset Management 2.0

Before we start elaborating on how asset management should evolve, we should outline the basics. Arguably there are seven main points that we should take into consideration when we discuss managing an energy-generating asset.

- We are managing an investment: a company – not just a plant.

- Markets constantly evolve where new possibilities and threats emerge.

- Long asset life cycles (30+ years) demand a long-term planning approach.

- “One size does not fit all”. Every asset has unique attributes and requirements, which may require a different management approach.

- Performance Optimisation and Value Increase comes from focused information-driven decision making.

- It is vital to make sure that business stakeholders and especially people working on the assets remain engaged and incentivised.

- Tested management practises should form the basis of the asset management framework which should be implemented across portfolios with the necessary adaptations.

Taking the above points into consideration, we need to develop the right “incubating” environment for asset management to evolve.

How could we take the traditional technical and commercial asset management functions to the next level?

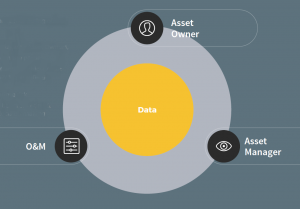

The first step of this evolution is to recognise that the current linear management approach, flow of information and decision making is not efficient. This linear approach prevents the flow of data and information from the asset to the asset owner and also limits and filters the information that the asset managers receive, which may create mistrust and a lack of transparency between the parties.

Source: Energybit © 2019

We need to transition to an asset-centric information-based management approach, where data capture and analysis will drive overall performance optimisation. This will enable the three main stakeholders to view the same set of data and make decisions based on pragmatic, valid information and not on unwritten rules.

Source: Energybit © 2019

This new approach will enable asset managers to address three key problems.

1) Loss of generation and income

2) Loss of time

3) Lack of transparency

The transition to Asset Management 2.0 should provide a holistic approach to how we view and manage assets. Apart from the adaptation of information systems and digitalisation, the development of continuous improvement processes is just as important.

Real value is created through proactive management

To put it simply, asset managers should increase the revenue (Alpha – α) through production improvements, revenue stream optimisation, innovation adaptation and at the same time reduce the cost (Theta – θ) through services optimisation, contract renegotiation, financial instrumentation and people management.

Through industry experience, we can identify six key processes that asset managers should effectively use to achieve continuous improvement and performance optimisation.

- Plant performance

- Operation cost reduction

- Financial restructuring / reengineering

- Legal and contractual renegotiation

- Technology adaptation and upgrades

- People management

These processes also form the asset optimisation cycle, which is the level that the asset manager should strive to operate at.

Quality systems and digital tools

An integral part of the asset management evolution is the adoption of quality systems and digital tools.

The first key element is the ISO 55001 standard on asset management which was published in 2014. However, there are very few asset management service providers that have been certified with ISO 55001.

Quality systems will provide the backbone of any standardisation for our sector and will indicate the internal transformational changes that service providers will have to undertake to improve their own organisations and deliver constant quality of service.

The second key element towards evolution is the adaptation of digital tools and information management systems. Even today, despite the multiple well-designed digital tools and platforms that exist, most asset management functions are performed on spreadsheets and communicated by email.

As a result, the asset owners and the industry are missing out on the historic value of information that derives from the assets and have information gaps, which restrain their capability of strategic, long-term asset management planning.

The industry will need to make a significant effort to adopt these quality systems and digital tools.

For asset management companies these two elements are critical and will help them stay competitive and deliver value to their clients. It is not a matter of choice but rather a matter of survival.

Asset management standardisation: Introducing Best Practices Guidelines

The need for asset management to evolve is unquestionable. However, a second challenge remains. How are we going to deliver service standardisation especially in a fiercely competitive, price-driven environment? Can we create a level playing field where asset owners know what to ask and service providers understand what they need to deliver?

Some sceptics would argue that process standardisation and scaling should be the responsibility of individual companies, which grants them a competitive advantage. Fortunately, industry experience has proven that this is not the case, especially when a whole industry is growing at an accelerated pace.

We have multiple examples from the IT and communication industries where standardisation helps to accelerate market adaptation and technology deployment driving down operational expenditure and raising standards.

Within our industry, we already have successful examples of industry associations, corporates and governing bodies coming together to establish standards and best practices for solar operation and maintenance (O&M).

A very successful example is the solar O&M Best Practices Guidelines, which were created by SolarPower Europe, the European solar energy association. Currently, version 4.0 of the Guidelines is being developed and now, the SolarPower Europe O&M and Asset Management Task Force, led by over 50 companies has started a new endeavour – the development of the Solar Asset Management Best Practices Guidelines. These Guidelines will be launched at the O&M and Asset Management event in London in December 2019.

Final thought – The social environmental aspect

It is yet to be determined at what speed the solar industry will progress. According to a new study by Energy Watch Group and LUT University of Finland, 100% renewable energy across all sectors is possible by 2050 with solar leading the way. In fact, the study finds that solar could become the largest and most affordable energy source, meeting up to 69% of global energy demand. The choices we make today as an industry will be instrumental in realising this huge potential. As an industry we are at the forefront of the energy transition and electrification of our societies. More importantly we are spearheading the fight against climate change. Solar cannot operate without the key service functions. Therefore, as solar is a key solution against climate change, our responsibility to evolve and adapt is even more critical. The Solar Asset Management Best Practices Guidelines is another step towards this aim.